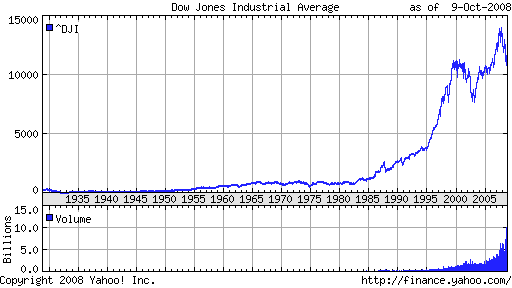

There's a line out there that moves up and down all day long. A lot of people watch it because they think it's a sign of how wealthy they are, or how wealthy they could be. Some people have killed themselves when the line goes too low, others have gone to jail. Some people are genuinely happier when the line is high up there, getting along better with their friends and family, whistling to themselves a bit more while they work.

Why do we watch this line so closely? Why do we so willingly and anxiously tie our happiness and sense of security and standing in the world to its altitude and slope?

Some veteran line watchers offer advice and comfort through an adage like "a watched pot never boils," meaning that you just shouldn't watch the line on a day to day basis lest you become frustrated with the time that positive change can take. But I am wary of this mindset, because the only acceptable outcome is still boiling, and so when the pot boils we are happy, and when the pot is not boiling, we lack happiness.

I wonder if there are other ways we can measure wealth? I wonder what it means to live in a world where we can be happy no matter where that line sits - perhaps even one where there is no line to watch at all?

"Naive!" some will say. "Foolish and unrealistic," will say others. And then they'll go back to watching the line, drumming fingers nervously, gut churning as fortunes rise and fall, hoping.

Looking at the above chart, I wonder what it meant to be happy in 1950 when the line was so "low." I wonder what it meant to be happy before the line got going at all. And of course, I wonder what's on the other side of the current peak, far to the right, off in the distance.

So, yes, though perhaps for different reasons and with a different notion of the boiling point, I'm watching the line too.

I’m a journalist, publisher, software developer and entrepreneur with experience as a founder and organizational leader. Work with me or learn more about me.

I’m a journalist, publisher, software developer and entrepreneur with experience as a founder and organizational leader. Work with me or learn more about me.

I'm sure you're familiar with the concept of "boom/bust". In the biological world, populations that grow too rapidly and consume all their resources eventually die down (rather rapidly) to a population size that can live on whatever resources are left. Rabbits have this problem, for example.

The other alternative is the "S-curve", where the growth is logarithmic but plateaus at carrying-capacity. This is the result of populations that recognize their sustainable levels and actively seek to reach it.

It's curious to notice that the proliferation of Internet usage strongly correlates with the growth curve. But looking at the progress of "the line", it's hard to say if we're headed for an "L-curve" (boom-bust) or an "S-curve" (at some carrying capacity).

I personally don't own any stocks (although as cheap as they're getting, I may consider it!) so this really doesn't directly affect me at all either. But anyone who reads my blog knows my feelings on the whole matter ;P

Well, here's another way of looking at it, which I suspect may be a little less technophobic or econophobic.

We all interact with our physical world to produce services and obtain services. Usually those are for and from other people, so that we can focus on what we're comparatively better at. Money is just a easy way of trading those services. Sometimes we need tools made by others to do what we do best, so we trade a portion of the services we produce (in exchange for our use of those tools). Then the guy we get the tools from can just trade his portion of those services for some other stuff he wants instead.

Here's a concrete example: Suppose I'm a heck of a fisherman, but I have no net. You give me a net, I promise to give you some of my fish that I catch with that net. That's stocks. If you say, "Hey, just give those fish to Shirley--she gave me a few sheep," then the "line" has been created. Secondary equity markets.

So the way I look at it, it's not a big deal. Hardly anybody should really care about the DJIA's value on a day-to-day basis because it's so volatile that one day's movement carries hardly any signal but a lot of noise. Until the tech bubble of the 90's made stock-watching fun for the populace as a whole, nobody really cared, just as they shouldn't.

I'm not sure if the DJIA really says anything about "carrying capacity" either. It's just a price, like the price of macaroni. Really it should've been put in logarithmic scale and adjusted for inflation.

I guess all I'm saying is that the DJIA might look and sound scary and weird, but it's just a normal natural part of human life. You find something like the DJIA in nearly every human society that has existed (just not at this level of sophistication). I don't think anybody seriously uses it to compare our standard of living of today with that of the past, so that's a bit of a straw man.

This post reminds me of this lady: